The market for Application Programming Interfaces (APIs) is booming, in particular when it comes to technology for financial services. The number of public APIs doubled between 2014 and 2015 alone. APIs let businesses easily hook disparate systems together with a corresponding reduction in integration times. The growth in cloud computing and web applications has driven much of this increase, with API technology for financial services leading the way. Businesses in these sectors are looking for new tools to streamline operations while remaining in control of end user computing. Most APIs are designed to link web-hosted services together, while platforms like iPushPull let you directly connect desktop applications to the cloud.

Cutting edge companies are realising their potential by incorporating API technology for financial services into their platforms. Google Maps for example, is one of the most widely incorporated APIs. Since 2005, it has allowed developers to embed location services into some of the most popular software today. The Facebook Platform, released in 2007, has API at its core and allowed third party apps to access social data. Established organisations within the financial services are also exploring open banking platforms to compete with new entrepreneurial entrants such as PayPal, TransferWise and Tilt. Partly as a result of their integration of APIs in their business models, these companies have become serious challengers in the payment industry. Now large financial organisations are trying to catch up and APIs have become the current backbone of opportunity.

The birth of APIs

The growth of Application Programming Interfaces can be traced back to the early 2000s, when Salesforce and eBay launched the first version of their services. The growth of cloud computing and, in particular, mobile apps accelerated this trend.

The growth of Application Programming Interfaces can be traced back to the early 2000s, when Salesforce and eBay launched the first version of their services. The growth of cloud computing and, in particular, mobile apps accelerated this trend.

Industries outside of the financial sector including media, travel, tourism, and real estate have embraced APIs for their services. This stems from a need to manage the growing quantities of data and enable better processing, therefore developing dynamic operational workflows. The commercial push to access all available data so that it can be monetised, has left a space for a new approach. Santander, for example, is turning to APIs to easily move data between internal and external providers. This solution has allowed Santander to stick with its existing large database providers, while allowing for a more flexible infrastructure.

API technology for financial services, as an effective solution

A common problem for financial services firms is the mix of technologies, computer systems and applications they use to run their processes. As they age these systems become incompatible with new technology and not only slow down processing but also allow for shortfalls. Even with point-to-point integrations, the systems become fragile over time and need maintenance, wasting resources and negatively impacting workflow. Through the construction of more efficient ways of working, institutions can improve existing services and positively impact the bottom line.

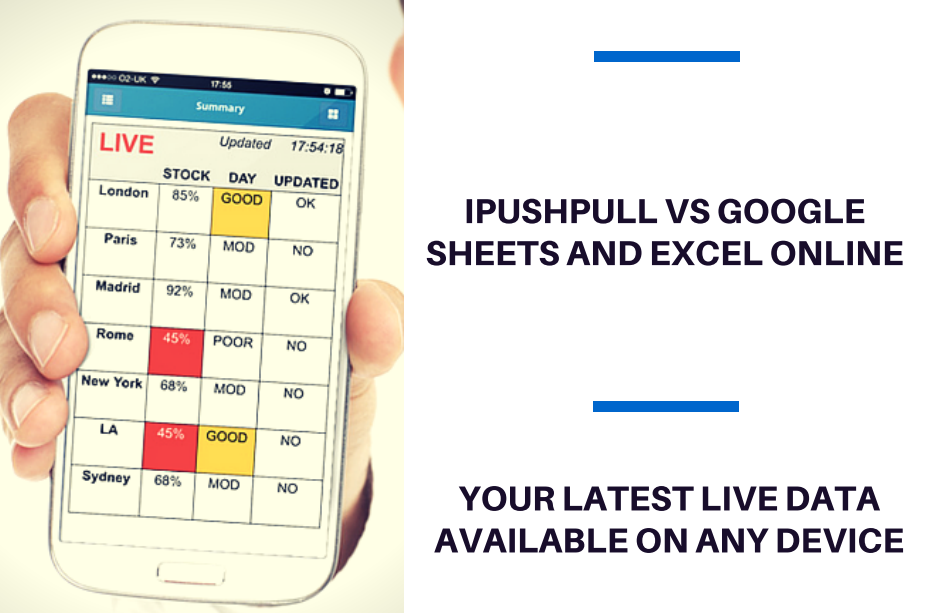

One example of a solution for such a problem in the financial services world is iPushPull’s API for live aggregation and distribution of data. Our API lets users share real-time data with their colleagues, customers and clients from even the most complex systems and services, and access it using familiar and flexible desktop applications like Microsoft Excel or on the Web. This helps institutions get the right data to the right people at the right time, without losing control – our security, access controls and monitoring let users control and track exactly who is using their data and how they are using it. To enable integration with the widest possible selection of applications and services, the iPushPull API is available for .NET, JavaScript and as RESTful and streaming web APIs.

Sign up for a free trial today, or contact us to find out more.

designed security from the outset and we always at the forefront of our considerations when designing and developing the platform. We’ve had end-to-end encryption since we started in 2014, but we don’t make it compulsory. We allow our users to enable it on a page-by-page basis, whenever they like, and adjust those settings as their privacy needs change. A new, more intuitive user interface is already in development which we hope will open encryption for spreadsheets to the masses in the same way Whatsapp has done for messages. Just as we strive to let our users take control of their content, we believe that they should have the tools to take control of the security of that content too.

designed security from the outset and we always at the forefront of our considerations when designing and developing the platform. We’ve had end-to-end encryption since we started in 2014, but we don’t make it compulsory. We allow our users to enable it on a page-by-page basis, whenever they like, and adjust those settings as their privacy needs change. A new, more intuitive user interface is already in development which we hope will open encryption for spreadsheets to the masses in the same way Whatsapp has done for messages. Just as we strive to let our users take control of their content, we believe that they should have the tools to take control of the security of that content too.