In a previous blog, we wrote about the competitive edge that data-rich financial institutions and solution vendors can gain by offering ‘Data-as-a-Service‘.

But what are some of the key considerations when it comes to cloud-enabling a firm’s existing legacy platforms? How difficult is it to offer live data or real-time data sharing through commonly used desktop apps such as Excel?

A bank, broker or asset manager might want to take on-premise data that sits on an internal platform – trade data for example – and seamlessly share that to the cloud, thus removing the need for end users to be onsite or to remote desktop in via a VPN.

Or a solution vendor with products designed for on-premise installation or access via dedicated lines and specific client software, might wish to go cloud-based in order to offer real-time or on-demand data sharing into existing applications and workflows without its customers having to rely on clunky FTP or building to APIs.

The good news is that enabling Data-as-a-Service on these legacy platforms is not as difficult as it might seem.

Enabling Data-as-a-Service on Legacy Platforms –

Real-time data sharing in the real world

Amongst financial institutions, many firms, on both the buy side and the sell side, are looking to gain greater leverage from their own internal systems by cloud-enabling them, thus improving the service they offer to internal colleagues and external clients. Whether that’s through making real-time data available within chat and collaborative workflow apps, feeding live data to and from Excel or sharing data via other desktop apps, there are many benefits that such an approach offers.

A good real-world example of this is the e-commerce fixed income department of a well-known bank, which uses its own internally-developed platform to generate trade axes from its current bond inventory. Working together with ipushpull, the bank has cloud-enabled this internal platform with secure, real-time data sharing, so that customers are automatically updated with new trade axes via their own choice of desktop apps (such as Symphony or Excel) and can respond with indications of interest directly from within those apps.

From a solution vendor perspective, there are many companies that have fantastic products and services, but live data sharing is restricted by the fact that their customers need to have software installed onsite or can only access data through FTP or API integration with a centralised service. A number of these vendors are now seeing the benefits of cloud-enabling these platforms to offer Data-as-a-Service.

Again, it’s worth citing a couple of real-world examples.

The first is a risk solution vendor that offers intra-day margin calculations. They have a great product that enables customers to load up their position data and calculate span margining for those positions on the fly. However, the product was originally designed to be installed on premise at the customer’s site, which made it expensive and meant that it could only be sold to larger institutions. By working with ipushpull to create a multi-tenant version with a secure cloud presentation layer, the vendor can broaden the service out to a wider, more diverse customer base and offer more affordable subscription-based or on-demand pricing models.

The second example is a data vendor that has a centralised multi-tenant platform, where customers download large data files and upload trade files via secure FTP. Again, their legacy installation and onboarding process meant that their commercial model was limited to larger customers. ipushpull helped the vendor cloud-enable this service to make the data available on demand, which has now opened up the service to a much wider group of potential customers.

Seamless integration of data sharing tools

The common thread with all of these legacy systems is that they handle data, with a set of inputs and outputs. And there is no fundamental, technical reason why they should not be cloud-enabled with data sharing tools.

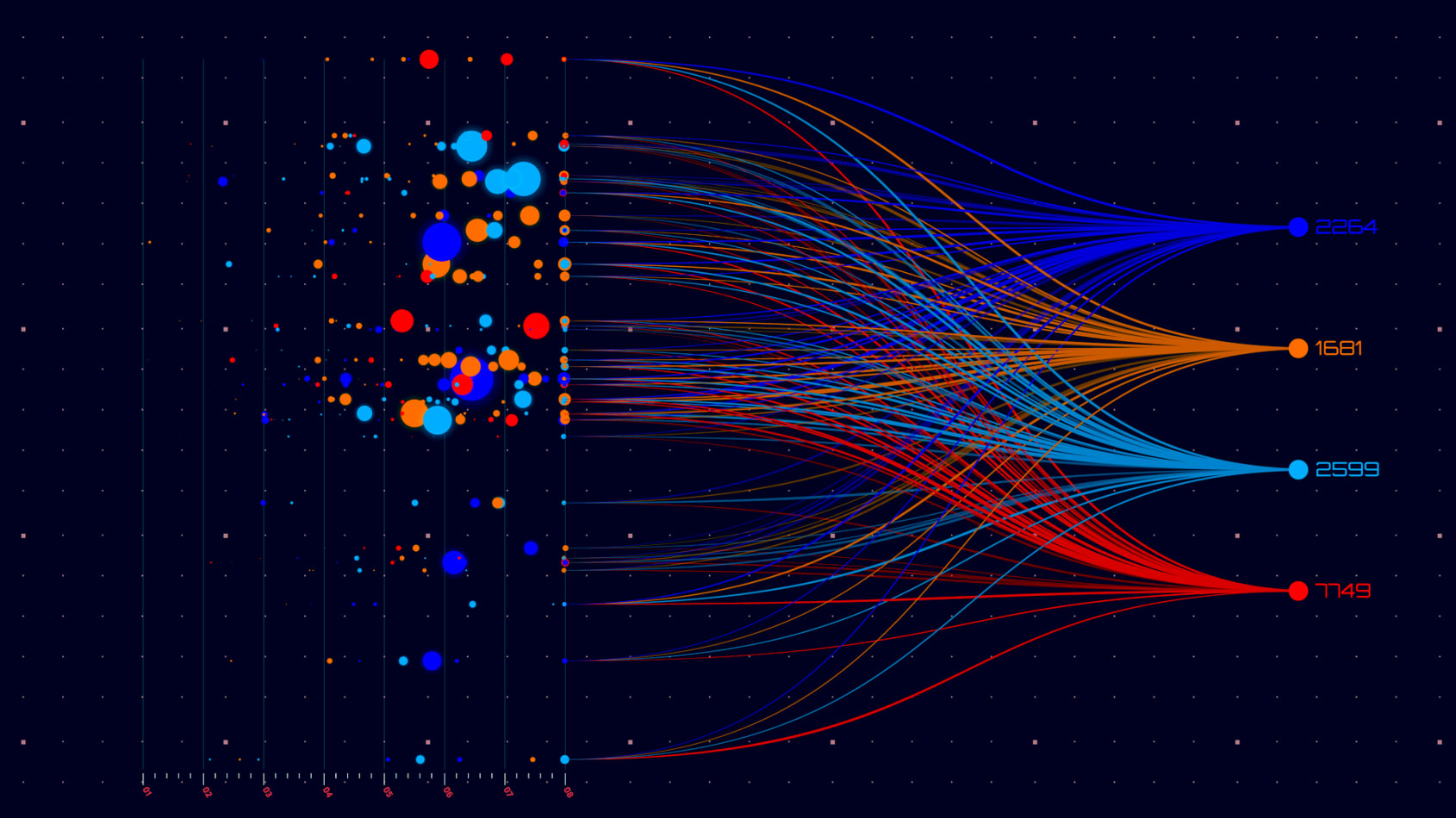

This is what ipushpull does. At the front end, we deliver these systems as true services with a unified presentation layer via the common desktop apps that people are already using. At the back end we develop APIs that plug into these legacy technologies. From the perspective of both service providers and end users, this is a completely seamless process. Services connect to ipushpull via the cloud and we take care of the rest, i.e. marshalling the data, providing access controls, presenting the data into multiple desktop apps and marshalling data back and forth to the service from within those apps in real-time.

Service providers benefit from not only being able to offer live and on-demand access through desktop apps like Excel, Slack, Symphony, Microsoft Teams and Eikon messenger, desktop containers like ChartIQ Finsemble and Openfin, and internal platforms and applications like pricing engines, risk systems and OMSs, without have to completely re-platform their existing systems, but also being able to deliver data-driven custom notifications into those apps based upon user-defined parameters.

In summary, Data-as-a-Service offers many benefits, and there is no reason that firms should be restricted to on-premise deployment or to API/SFTP integration. By working with a trusted partner such as ipushpull, firms that are looking to cloud-enable their internal platforms can minimise their internal development costs, broaden their reach and rapidly accelerate their time to market.

.

Download “Fintech’s Next Frontier: Data-as-a-Service” our Financial Markets Insights report. In collaboration with Natwest Markets, Maystreet, Euromoney TRADEDATA and Engine, part of The Investment Association, ipushpull explores the importance of Data-as-a-Service in facilitating remote working and accelerating digital initiatives within the financial markets industry.

.