Proprietary Traders, Brokers, Clearing Services and their clients all need to know the market exposure and risk to their firms at any given point in time. Risk managers often sit in front of multiple screens monitoring positions in real-time from multiple risk modules on different trading platforms. Without expensive development work or costly enterprise risk systems, there is no way to automatically aggregate market risk, trading positions and P&L’s in real-time from multiple trading and risk platforms in multiple locations.

Principles of Risk Aggregation – BCBS239

In addition to trading risk, since the financial crisis, regulators have introduced new broader rules such as BCBS239, ‘Principles for Effective Risk Data Aggregation and Risk Reporting’, aiming to strengthen risk management at banks and reduce the chances of future instabilities in the global financial system. However, many key challenges such as budgetary pressures, old legacy systems and complexity in consolidating risk from different locations means many banks and other financial organisations are unable to automate necessary risk frameworks. This often leads them to resort to manual workarounds which are slow, cumbersome and can lead to human error.

Consolidate your real-time risk

iPushPull offers a plug-and-play solution which can be set up with no integration or development work. Our service enables the automatic consolidation of risk periodically, or in real-time, from multiple locations and multiple sources.

Risk can be aggregated at any level, from high-level summaries for executive management to detailed reports for risk managers who need to drill down to traders’ individual positions. iPushPull’s technology integrates with popular desktop applications, like Microsoft Excel. It also makes it easy to set up customised alerts, view risk on mobile devices and permission and share risk dashboards with other departments or clients. The platform offers end-to-end encryption and a full audit trail with history of every single price update and who looked at it, when and where from.

Automate and consolidate your risk management controls with no development work using iPushPull and share securely with other departments and clients. Sign up for a free trial today, or contact us for further information.

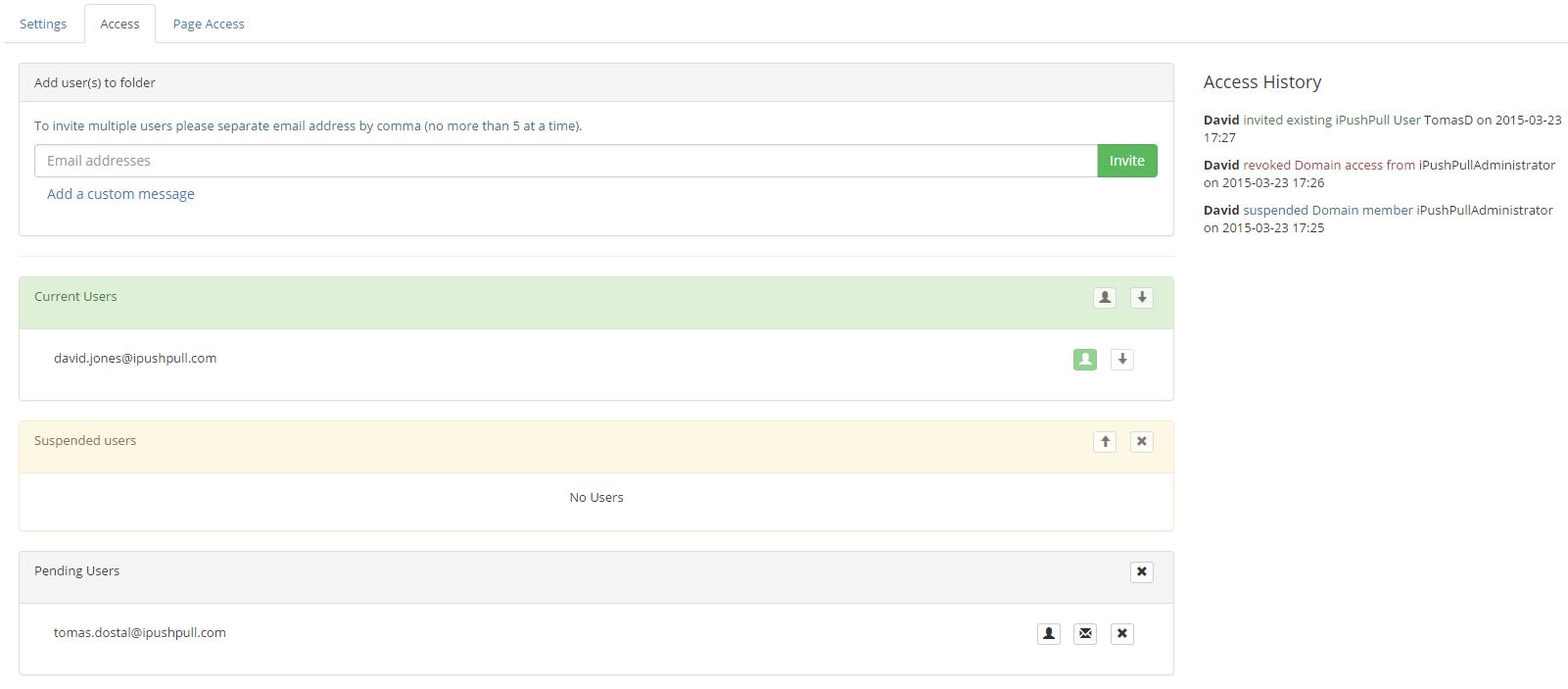

designed security from the outset and we always at the forefront of our considerations when designing and developing the platform. We’ve had end-to-end encryption since we started in 2014, but we don’t make it compulsory. We allow our users to enable it on a page-by-page basis, whenever they like, and adjust those settings as their privacy needs change. A new, more intuitive user interface is already in development which we hope will open encryption for spreadsheets to the masses in the same way Whatsapp has done for messages. Just as we strive to let our users take control of their content, we believe that they should have the tools to take control of the security of that content too.

designed security from the outset and we always at the forefront of our considerations when designing and developing the platform. We’ve had end-to-end encryption since we started in 2014, but we don’t make it compulsory. We allow our users to enable it on a page-by-page basis, whenever they like, and adjust those settings as their privacy needs change. A new, more intuitive user interface is already in development which we hope will open encryption for spreadsheets to the masses in the same way Whatsapp has done for messages. Just as we strive to let our users take control of their content, we believe that they should have the tools to take control of the security of that content too.