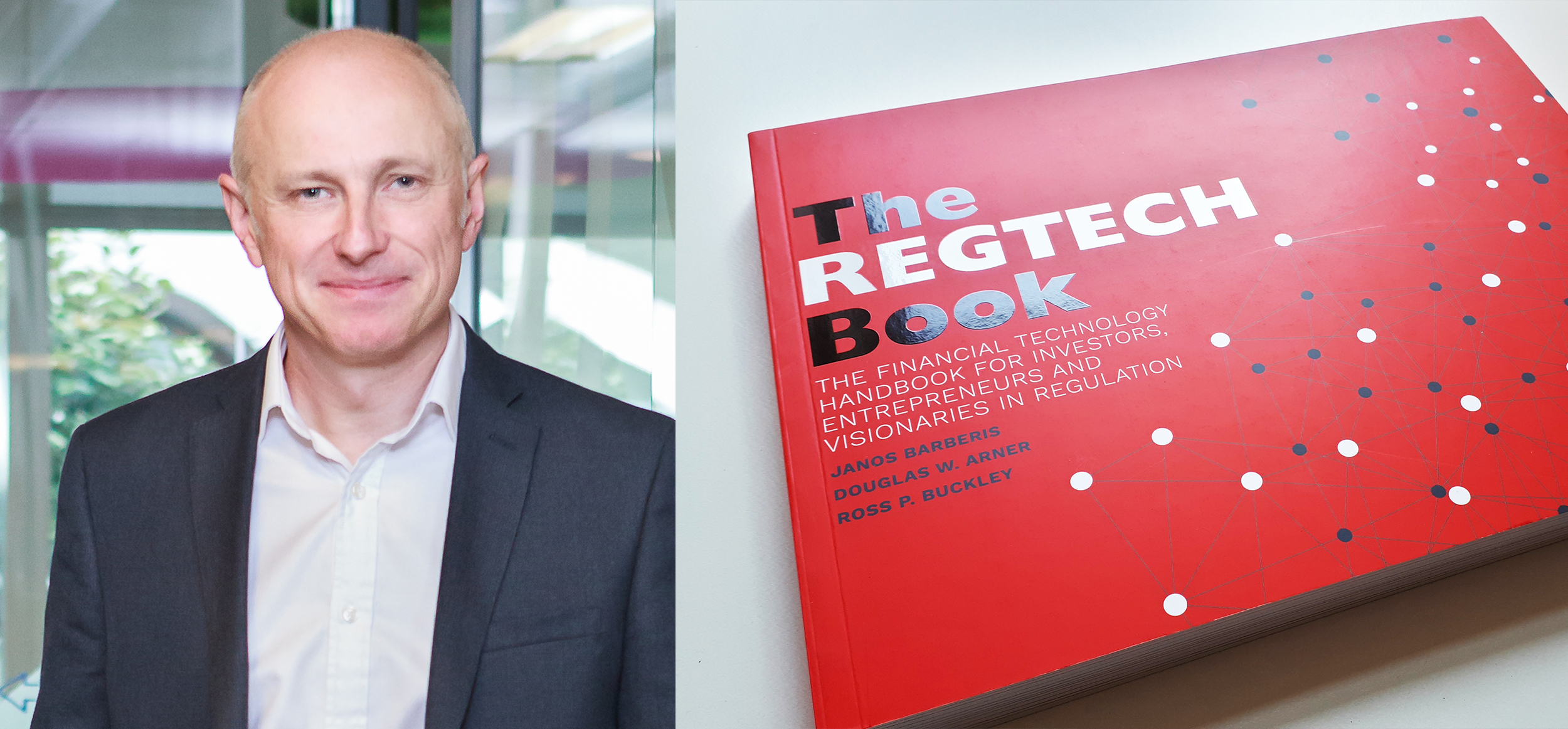

James Maxfield, Managing Director, Ascendant Strategy

James Maxfield, Managing Director, Ascendant Strategy

Digitalisation has been a hot topic for several years within the post trade environment, with industry commentators forecasting a revolution on par with the transformation of sales and trading, that years of electronification brought to the front office. But despite all of the posturing and big intentions, little has materially changed outside of pockets of innovation led by start-ups such as Access Fintech trying to drive industry collaboration. Email continues to be the dominant communication tool of choice, with spreadsheets and PDF’s being leveraged on the whole to provide the content to feed exception management processes. And in some cases, faxes still persist for the exchange of confirmations or signed documents that require validation against physical signatory lists.

That is not to say that there isn’t demand for innovation – there is significant pent up frustration at the C-level around the number of people typically involved in the process – but the lack of significant progress is more a reflection of prioritisation and allocation of resources to drive these agendas. With time and resources an increasingly scarce commodity for all but the largest global players, focus for most has been trying to keep on top of the day job. The fragmented operating models that persist for most after a decade of near and far shoring, creates an increasing disconnect between senior leadership and those doing the job on the ground. All of which makes the digitalisation agenda a thing to envy for most post trade leaders.

So, given the complexity of this problem, how will the current situation provide a catalyst for change that a decade of industry cost pressure has been unable to create?

Here are some reasons why.

- Leaders are being forced to lead digitally. The pandemic crisis has fast tracked a generation of leaders into the digital age, in a way that no-one could have predicted. And being intelligent people, they are seeing the benefits this can bring. Ascendant Strategy spoke with the client service head in the markets division of a bank who was delighted with how Zoom was able to connect him with his teams. This was no sleight on his digital savviness, but more a reflection around banks still relying on old world tool sets to manage their day to day workload. They have now seen what is possible in terms of communication mechanisms such as Symphony, Slack and Microsoft Teams. And they like it.

- Operational Resilience. This has been a focus area for some time by the UK regulator and will continue to be a global focus in the future. And whilst some will justifiably claim that the scale and impact of the pandemic could not be predicted, all regulators will expect resilience models to be updated to reflect the impact of it.

‘Delivering operational resilience requires firms to take decisive and effective actions, for example by replacing outdated or weak infrastructure, increasing systems’ capacity or addressing key person dependencies.’ FCA

These expectations will force organisations to look hard at capacity constraints and key person or location dependencies (individuals and groups) that have arisen and rethink some of their historic investment decisions. And whilst some commentary reads that this will push a ‘jobs return home’ agenda, we see this as uninformed opinion on the whole. Near and far shore centres provide well educated talent pools, capacity and skills that do not exist in the local job market – so Ascendant Strategy does not see a material shift in the global make up of resourcing. Besides, multi-location sites provide valuable BCP benefit (albeit of little value in a global lockdown). But where the investment decision was based solely on ‘cost of automation’ vs ‘cost of manual processing’ expect to see greater emphasis now being placed on how automation can deliver improved resilience.

- ‘Old School’ management no longer works. Traditional approaches to crisis management and severe market volatility typically relied on ‘old-school’ management styles. Key people (typically process experts) huddled together in a war room, from 7am till late with whiteboards and spreadsheets. With leadership getting into the detail and providing command and control through experience gained in prior battles. Tea and medals were won during these periods, with battlefield promotions not being uncommon. However, this is already showing itself as being unsustainable during this extended lock down period – anecdotally, fails and collateral management are key pain points within the industry right now – highlighting the lack of standardised processes and pinch-points within many post trade processes that cause them to lack scale in stressed situations. And these areas will have cost firm’s real money in terms of operational losses, given the ongoing levels of volatility (VIX has been over 80 in March 2020, having reached 30 once in the prior 5 years). People will adapt, but the reality is that this will force a change in leadership style (and leaders in some cases), pushing demands for process standardisation and greater levels of automation. All of which will unlock opportunities for digital solution providers.

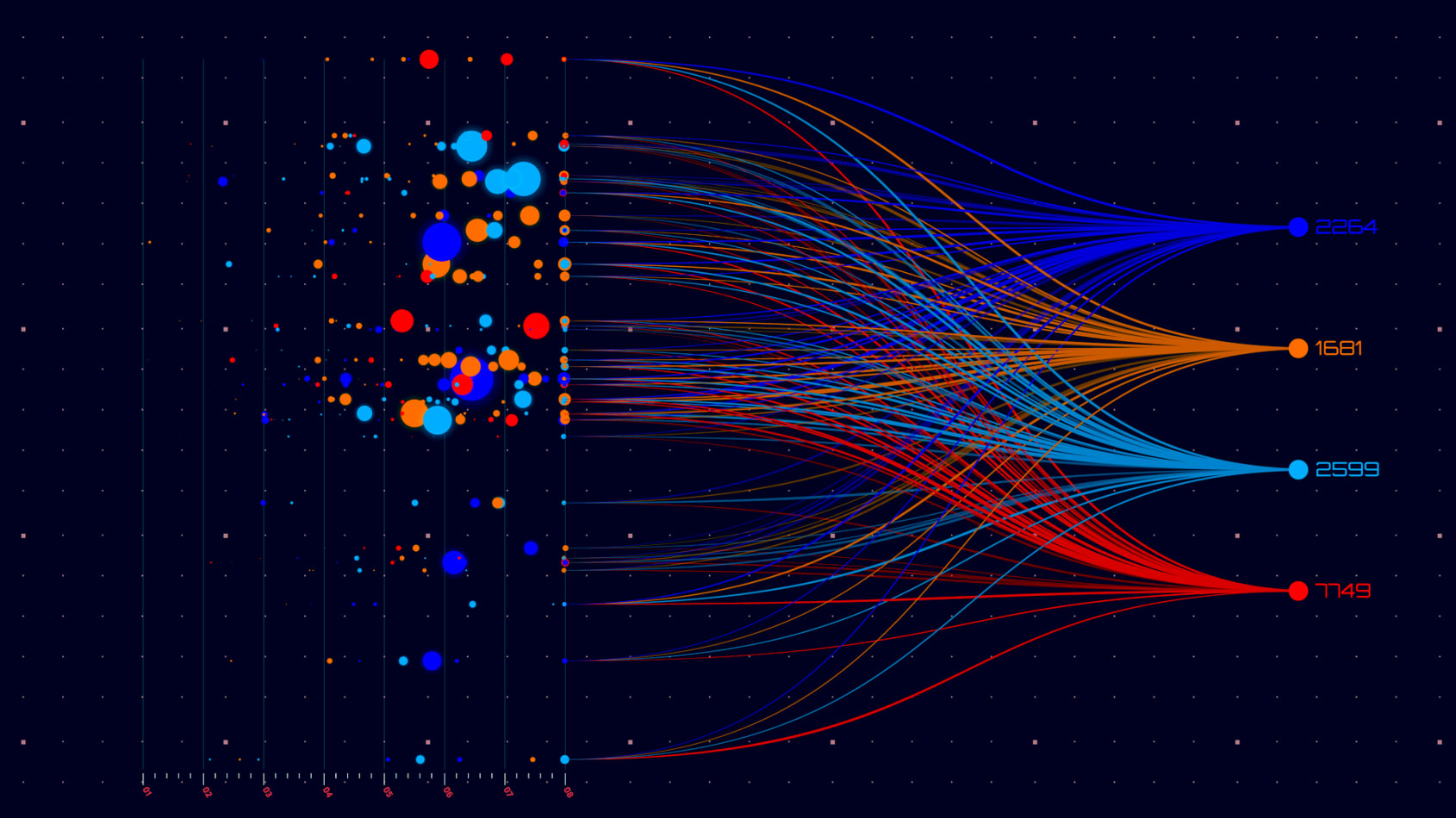

- The demise of the shared inbox. As the post trade process adapts quickly to the capabilities digital communication channels provide, other tool sets will quickly follow. Where FinTech’s have existing integrations with these channels, they will find opportunities to use them as a beachhead to accelerate opportunities to deliver automation and efficiency into the post trade space. The change is already happening with, for example, firms like ipushpull offering real-time workflow apps and notifications and as a service across multiple channels including chat applications. This is driving fast change with low hanging fruit such as the shared inbox being rapidly demoted as the preferred workflow tool.

The world is faced with a crisis that no-one would have predicted 6 months ago – and focus quite rightly is now tuned to survival. But once this passes and some sort of normality returns, reflection will start. And it is this process of reflection that will provide opportunities for FinTech’s to help capital markets firms accelerate their post trade digital agendas.

About Ascendant Strategy

Ascendant Strategy is a specialist post trade consultancy operating within capital markets. We bring technology and operations together, bringing experienced, practitioner expertise to deliver transformational outcomes for organisations where complexity has overpowered efficiency.

Find out more here at www.ascendant-strategy.com or follow us on Linkedin or twitter @Ascendant_Strat.

.

Download “Fintech’s Next Frontier: Data-as-a-Service” our Financial Markets Insights report. In collaboration with Natwest Markets, Maystreet, Euromoney TRADEDATA and Engine, part of The Investment Association, ipushpull explores the importance of Data-as-a-Service in facilitating remote working and accelerating digital initiatives within the financial markets industry.