Financial markets firms are increasingly capitalising on their data by taking advantage of cloud-based technologies that enable them to seamlessly connect with desktop applications. In a recent webinar, industry experts discussed how Data-as-a-Service enhances client experience, widens digital distribution channels and provides better workflow efficiency and automation for end-users.

Microsoft reported a record fiscal year in July 2020 with commercial cloud revenues surpassing $50bn for the first time, an increase of more than a third from a year ago. Satya Nadella, chief executive officer of Microsoft, said on the earnings call that the previous five months had shown that digital technology intensity is key to business resilience. Nadella said: “Organisations that build their own digital capability will recover faster and emerge from this crisis stronger. We are seeing businesses accelerate the digitisation of every part of their operations to reimagine how they meet customer needs.”

Financial services firms have needed to digitise as Covid-19 has forced working from home while maintaining the same service to their clients. The Realization Group hosted a webinar in July 2020 with a panel of experts to discuss how firms of all sizes, from the sell side to the buy side, can use Data-as-a-Service to emerge better, faster and stronger in the post-pandemic world.

Data sharing in capital markets has historically been a very manual process, involving emails, file sharing and copy and pasting. Matthew Cheung, chief executive of ipushpull, explained that Data-as-a-Service (DaaS) allows firms to automate this process and seamlessly connect their data to their clients while providing the first or last mile of connectivity to end-user applications.

The fintech ‘pulls’ the required information from a database, a platform or even a spreadsheet and ‘pushes’ it to recipients in applications they already use, such as Excel spreadsheets or a chat platform. Clients will have preferences on whether that data is live, streaming or on-demand and DaaS can also meet the capital markets regulatory requirements of security controls and audit trails.

“The cloud is an enabling technology so Data-as-a-Service allows firms to share data in any application and it is all plug-and-play,” Cheung added. “Covid-19 has accelerated cloud adoption and digital transformation projects across markets.”

This was backed up by a poll which found that the vast majority of the audience, 85%, had heard of DaaS. In addition, Covid-19 was the top factor driving their firm’s digital transformation with 30% of the vote.

Capital markets firms have traditionally built their own technology but John Macpherson, deputy chair of the Investment Association’s advisory panel for Engine, a fintech accelerator for the asset management industry, said that ship has sailed. More than half, 58%, of the audience agreed as they said they would buy, rather than build, DaaS technology.

Macpherson added: “The buy side very much looks at DaaS as a cost-efficient responsive service that allows them to focus on selling their products.”

Data-as-a-Service also creates a faster path to innovation, giving firms a more agile decision making process and a more data-driven culture which lowers risk and leads to higher revenues.

“Once these dots are connected DaaS will become more prevalent,” said Macpherson. “There are phenomenal opportunities from getting the right data at the right moment in the right format so that people can make better decisions.”

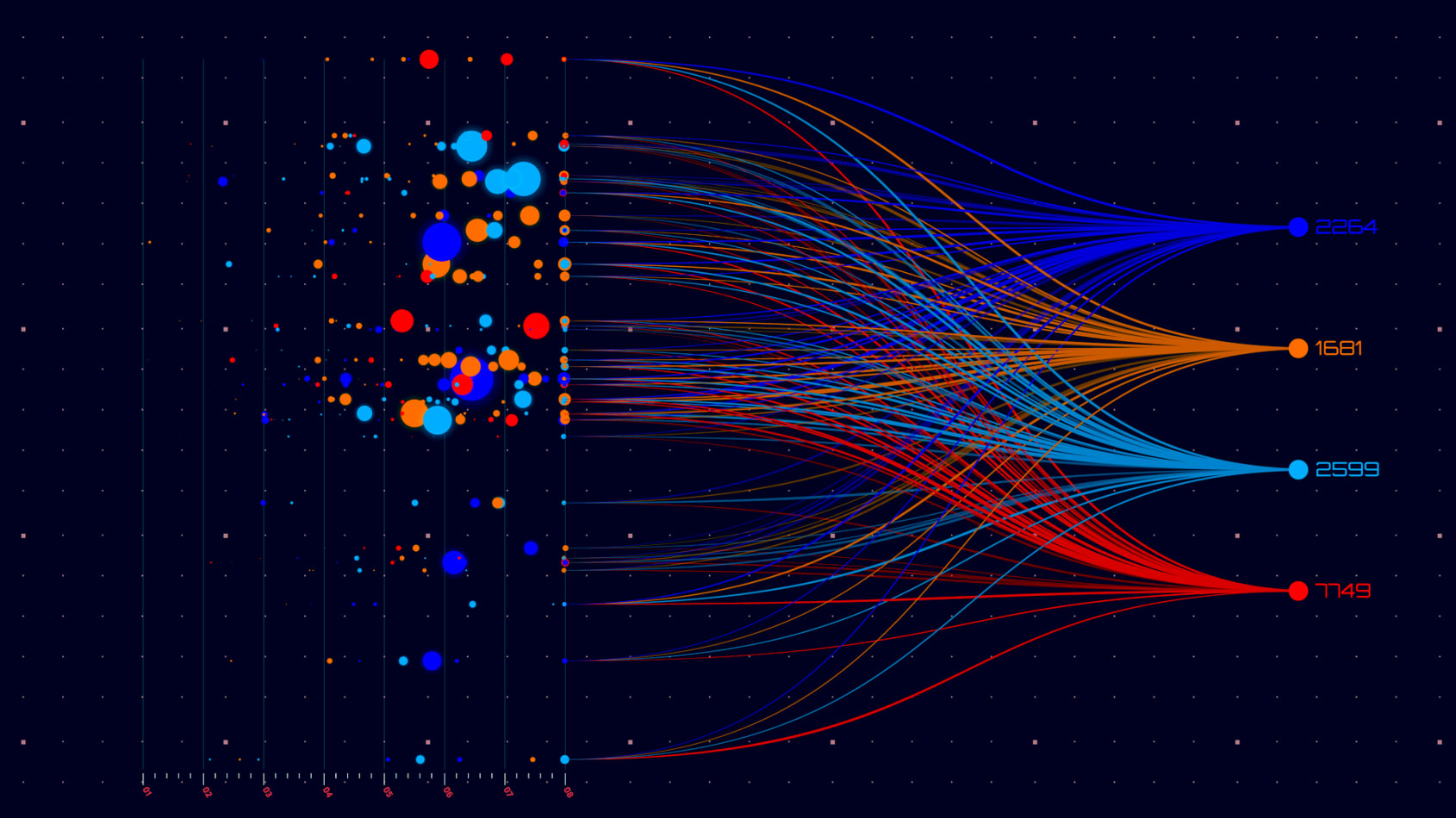

Patrick Flannery, co-founder and chief executive of data infrastructure provider MayStreet, broke down the four stages of using data effectively – collection, storage, transformation and delivery. Each stage presents a challenge, for example, storing large amounts of data can cost hundreds of thousands of dollars per month in each region. Flannery said: “Firms will have an ocean of unstructured data. They need to pull out the relevant piece and then integrate it into their downstream workflow. Giving it a go themselves may actually give them a first-hand view of the resources needed to do it right and push them into the direction of DaaS.”

Julien Dugat, fixed income client execution platforms and digital sales at NatWest Markets, explained that the main reason the bank chose to use ipushpull, rather than build, was the speed to market of using an off-the-shelf product.

“You don’t need to spend ages customising the product and integrating it with your own data feed, so you can get going really quickly”, Dugat added.

NatWest Markets uses electronic venues’ FIX API’s and ipushpull to distribute tens of thousands of daily axes to clients more efficiently than through phone calls or emails. Automating the process means the axes are always up-to-date, actionable, relevant and easy to access by clients. The bank sends a stream of live data to the ipushpull cloud and clients can pull the data in their preferred format, such as Excel or a Symphony chat. The majority of the audience, 63%, said they would prefer to use Data-as-a-Service through APIs, followed by Excel and then Symphony apps and bots.

Dugat said: “Clients don’t need to install anything on their desktop but can, for example, access our data through Symphony or the ipushpull web app or mobile app so it is a very low barrier to entry.”

The NatWest sales desks also use ipushpull to easily send highly targeted relevant axes to specific clients. A client may want auto sector bonds, and the salesperson can filter the axes and send them by clicking one button. Clients can also trade axes more efficiently as the bank has integrated ipushpull with SCOUT, an execution bot in Symphony.

Dugat said: “It is about getting the right data to the right person at the right time. Rather than just inundating everybody with lots of data, we make it relevant.”

Mark Woolfenden, managing director of futures and options reference data supplier Euromoney TRADEDATA highlighted that DaaS provides opportunities for small and medium-sized firms to access the same high-quality data as large firms, as they would be able to pay just for the data they used.

“More flexible business models could include offering data on-demand as part of the trade lifecycle from pre-trade risk validation to post-trade regulatory compliance and portfolio management,” Woolfenden added.

Cheung concluded that he expects digitisation and DaaS to become more common. He said: “Moving to this new way of data sharing unlocks efficiency and automation, so humans can spend time on higher-value tasks.”

Contact ipushpull at sales@ipushpull.com for further information or for a live demo of Data-as-a-Service in action.